Ronald Reagan, often hailed as one of the most influential US presidents, implemented an economic strategy known as Reaganomics during his tenure from 1981 to 1989. Reaganomics aimed to revitalize the American economy through a combination of tax cuts, deregulation, and reduced government spending. This article seeks to assess whether Reaganomics was a successful economic strategy for Americans by analyzing its impact on key economic indicators, income distribution, and long-term implications.

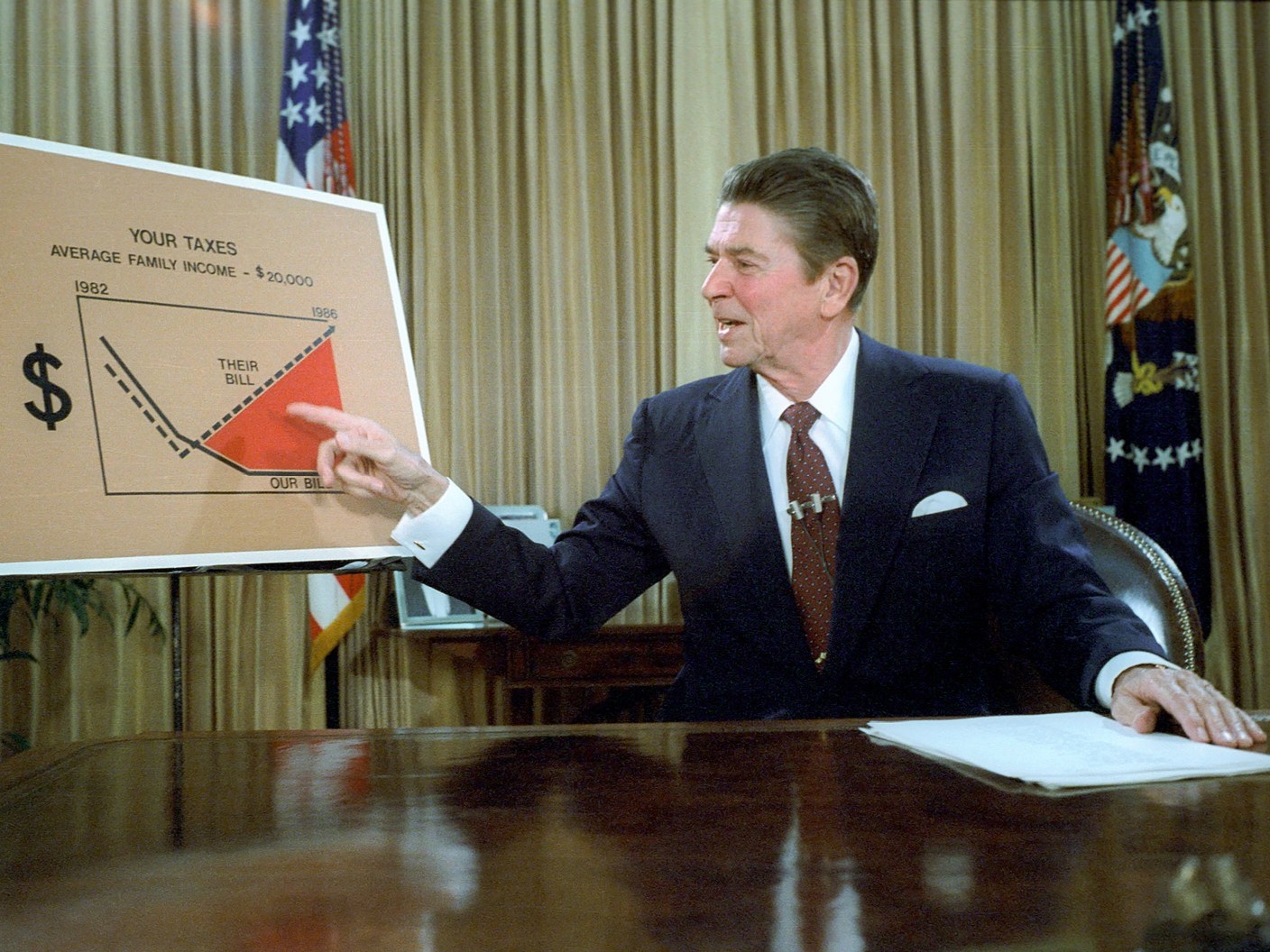

One of Reaganomics’ primary objectives was to stimulate economic growth. Proponents argue that Reagan’s policies fueled a sustained period of economic expansion, citing the reduction in the top marginal income tax rate from 70% to 28% as a significant catalyst. They argue that these tax cuts boosted consumer spending, increased investment, and promoted entrepreneurship, leading to higher GDP growth rates during the Reagan era. However, critics argue that other factors, such as technological advancements and lax monetary policy, played a more significant role in driving economic growth, and Reaganomics merely coincided with these trends.

Income Distribution

An important aspect to assess the success of Reaganomics is its impact on income distribution. Critics argue that it exacerbated income inequality in the United States by disproportionately benefiting the wealthy. The reduction in tax rates for the highest income brackets allowed the wealthy to accumulate even more wealth, exacerbating the wealth gap. On the other hand, proponents argue that Reaganomics’ focus on supply-side economics eventually led to widespread economic prosperity, benefiting all income groups. They posit that as the overall economy grew, opportunities for job creation and upward mobility increased, improving the well-being of middle and lower-income Americans.

Long-Term Implications

To understand the success of Reaganomics, it is crucial to evaluate its long-term implications. Proponents argue that Reagan’s policies laid the foundation for the economic booms of the 1990s and early 2000s, citing decreasing inflation rates, increased business investment, and technological advancements as evidence. They contend that Reaganomics stimulated economic growth in the long run and paved the way for sustained prosperity. Critics, however, claim that Reaganomics contributed to widening income inequalities, weakened the social safety net, and led to the accumulation of national debt. These long-term consequences, according to critics, outweigh short-term economic growth.

Unintended Consequences

Another aspect to consider when evaluating the success of Reaganomics is its unintended consequences. Deregulation and tax cuts, although intended to spur economic growth, also contributed to the savings and loan crisis of the late 1980s and the financial crisis of 2008. Critics argue that these crises are evidence of the risks associated with Reaganomics’ laissez-faire approach. Moreover, critics contend that reduced government spending under Reagan led to cuts in social welfare programs, resulting in hardships for many vulnerable Americans.

Conclusion

Evaluating the success of Reaganomics as an economic strategy for Americans is a complex task. While Reaganomics undeniably stimulated economic growth during the 1980s, its long-term consequences and effects on income distribution remain subjects of debate. Proponents argue that Reagan’s policies laid the foundation for extended periods of economic prosperity, while critics contend that it exacerbated income inequality and perpetuated a cycle of wealth accumulation. Ultimately, the assessment of Reaganomics depends on individual perspectives and priorities, making it an ongoing topic of discussion among economists and policymakers.